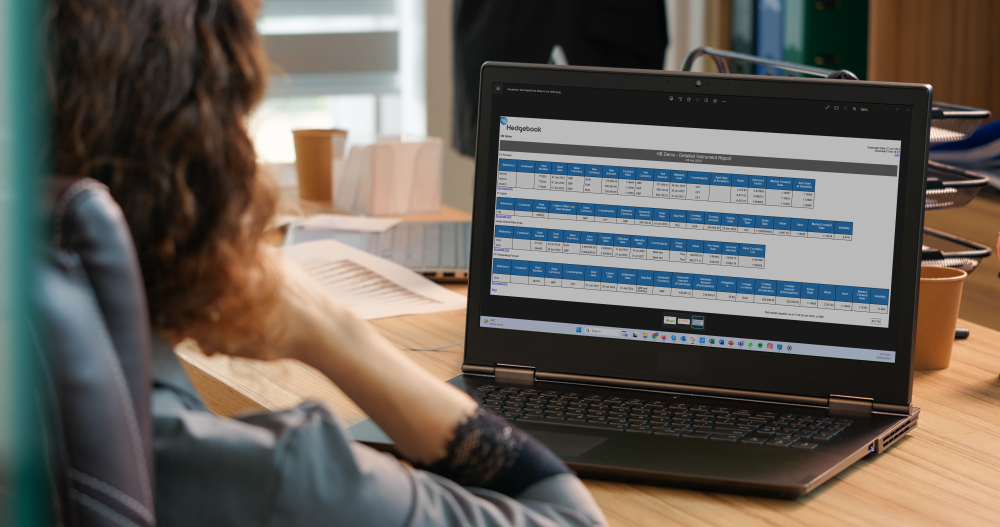

Why you need Hedgebook's Valuations Tool

- Hedgebook gives you FX valuations instantly.

- Supports IFRS 9, CVA/DVA for IFRS 13, and IFRS 7 calculations and hedge accounting sensitivity testing.

- Recognized as a third party, independent valuation.

- Bring greater predictability into your day-to-day hedging decisions, while ticking all the boxes.

But that’s not all – sensitivity reporting’s included

The sensitivity reporting built into Hedgebook’s valuation tool, lets you understand the impact of moving exchange rates. You can now predict the outcome of market movement with greater accuracy and manage more effectively within your policy limits. It makes Hedgebook, deservedly, one of the most comprehensive, yet cost-effective, TMS on the market.

Independent and compliant

"We were relieved to find a tool to do this for us that was both third party independent and ensures we are compliant with the auditing standards.”

Grant Roger, Audit Partner, Johnston Carmichael

Trusted independent valuations

In a time of unprecedented uncertainty Hedgebook’s valuation tool brings credible, fact-based, accuracy to the predictions and decisions you’re making. In managing your FX risk you need to know more than just the exposures, cashflows and hedges. You need independent valuations. In fact, you need the exact valuation, mark-to-market or fair value. And you need it now.

Actionable insights

Detailed analysis

Increase value

Compliant

Cost effective

Quick'n'easy

Independent

More than just a valuation tool

"Hedgebook is more than just a valuation tool, it’s a day-to-day management tool helping engage the Board and the bank in a more meaningful way."

Simon Boyd, Hamilton Jet