Companies will often hedge foreign currency exposures against harmful exchange rate fluctuations. Having decided to enter financial instruments, such as forward exchange contracts and options/collars, it is necessary to evaluate the impact of the FX hedging decisions being made and performance of the hedging programme. There are a number of reasons companies will transact hedging not all of which are about “beating the market”. Stabilising selling prices or input costs, reducing volatility of profits, gaining a competitive advantage or displaying strong controls and risk management to key stakeholders are all good reasons to hedge FX.

Regardless of the reason for hedging, an evaluation helps with understanding whether the company has achieved its FX hedging goals. It confirms whether the hedging strategy has been successful, determines whether the choice of hedging instrument was appropriate, challenges whether anything could be done differently e.g. perhaps paying some premium for options might have delivered an enhanced result.

Assessing the impact of FX hedging decisions

There are a number of metrics for assessing the success of an FX hedging strategy:

- Was the prevailing market rate at the maturity of the contract better or worse than the rate the contract was entered at?

- What is the P&L impact at the maturity of the contract?

- What is the weighted average rate of all FX contracts that matured in the last month/period i.e. the average conversion rate?

- Did the conversion rate beat expectations/budget?

- Would the company have been better off doing nothing?

It is important to address these questions otherwise the success of the hedging is too subjective. So how can a company easily understand the impact of its hedging decisions? Systems such as HedgebookFX can provide most of the answers.

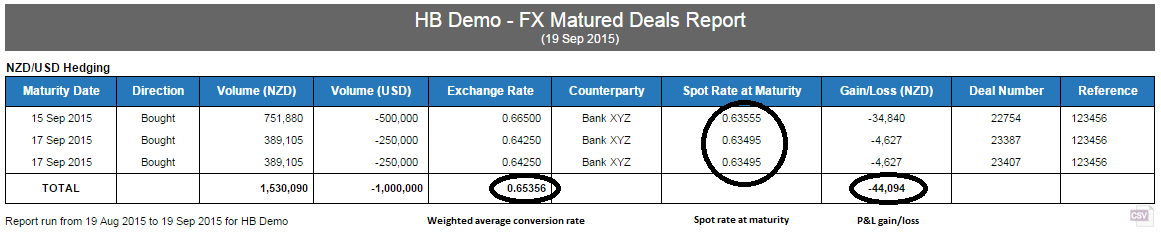

Matured Deals Report

For example HedgebookFX’s Matured Deals Report includes the prevailing market spot rate at the maturity of the contract, the P&L impact and the conversion rate for the month.

Having a benchmark rate to compare against is also helpful. The company’s monthly conversion rate can be compared to alternative hedging approaches such as no hedging (spot rate), passive hedging (mid-points of policy risk control limits, if the company has one) or some other mix of hedging instruments and/or duration of hedging. The chart below plots the NZD/USD exchange rate achieved over the last five years under three possible approaches:

- No Hedging (spot)

- 100% hedged six months forward using FX forward contracts

- 50% hedged 12 months forward using FX forward contracts

- The No Hedging approach has unsurprisingly produced the most volatile outcome. With no protection in place, the business’s performance is exposed to the whims of the global exchange rate markets.

- The 100% Hedged approach has smoothed out the peaks and troughs substantially. This approach is passive i.e. new hedging is entered every month (out to six months) regardless of prevailing market conditions and expectations for the future direction of exchange rates.

- The 50% Hedged approach lands somewhere in between. Longer term hedging is particularly appealing for NZD exporters due to the benefit of the forward points, a result of New Zealand’s higher interest rate environment. However, there is still exposure to the spot rate given only 50% is fixed.

Some businesses have the ability to pass through impacts from exchange rate fluctuations to their customers and so not hedging can be a legitimate course of action. For others, margins are skinny and even small exchange rate movements can have devastating consequences. Thus, the hedging approach must be appropriate for the business’s risks. The benchmarks used to evaluate the hedging programme must also be appropriate.

In summary

Using a passive benchmark allows the business to understand the value added by the decision makers i.e. hedging decisions are captured within the actual conversion rate. The conversion rate is the outcome from active FX risk management. Critically evaluating the outcomes from hedging allows the business to gauge the success of its hedging programme.

If you would like to know more about Hedgebook might help you hedge more effectively please set up a quick online demo with one of our team.

You may also be interested in taking a quick look at this video on using geared forwards in Hedgebook.