Like everyone in the industry we have been closely following what has been happening around UBS with several hundred clients who suffered significant losses from complex foreign exchange derivatives, known as “conditional target redemption forwards” or (TARFs), as a result of market volatility triggered by U.S. President Trump’s tariff announcements in April 2025.

It is a timely reminder that FX transactions aren’t all the same ‘flavour’. ‘Vanilla forwards’ are aptly named – that everyday icecream flavour everyone is well acquainted with and knows exactly how it should taste. Even the most inexperienced cook can confidently use vanilla icecream.

What flavour are your forwards?

However – it takes considerable knowledge and some real degree of expertise to know how Lobster Icecream should taste (yes, it really is something you can buy) and how to use it. The TARF products under scrutiny from UBS clients would definitely fall into the Lobster Icecream category.

They are typically suited for sophisticated investors and that is why it became problematic as the Swiss franc surged against the dollar resulting in reportedly hundreds of millions of Swiss francs in losses. Seemingly some clients, including wealthy individuals and some large retailers, lacked the deep financial expertise to manage conditional target redemption forwards in these conditions.

Hindsight is always a wonderful thing – and the UBS story is still unravelling. But it does beg the question – where would Hedgebook play in this arena?

While you can definitely capture TARF products in Hedgebook, we cannot calculate the mark-to-market valuations on them. They are notoriously hard to value and even the most sophisticated and expensive Treasury Management Solutions draw the line at valuing TARFs.

Advantage of capturing TARFs

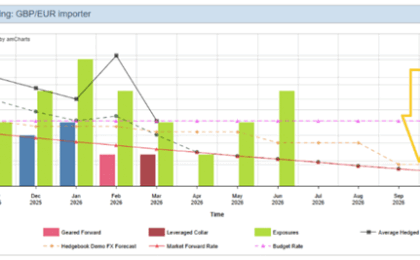

However, the advantage of capturing TARFs in Hedgebook is that you can show them in the FX Exposure Tool. It enables you to understand your hedging position (% hedged, rate achieved, position versus policy limits).

In moving the slider in the FX Exposure Tool you can see what happens to the product under a change in exchange rate. You can provide your own scenarios so that you can understand how your position changes. Do you have more or less hedging than at prevailing rates?

It means the FX Exposure Tool is very good at showing the “what-if” position and hedged rates – but we don’t pretend to calculate the mark-to-market valuation. One of our latest customers has a broad range of TARFs and the main driver of capturing them in Hedgebook was to get a better handle on their overall hedging position – which is what Hedgebook and the FX Exposure tool does very nicely.

We would like to think – at the very least – using Hedgebook would have flagged these exotic products as something a bit different to the usual vanilla fair and provided a window for some foresight into potential issues should market conditions change.

Like to learn more about FX Forwards? Or better understand your forex risk exposure? Check out our guide to FX Exposure for Corporate Treasurers or set up a call with one of our team.