Hedgebook is on a mission

With offices in the United Kingdom and New Zealand, Hedgebook helps finance professionals all over the world to better navigate treasury risk management decisions.

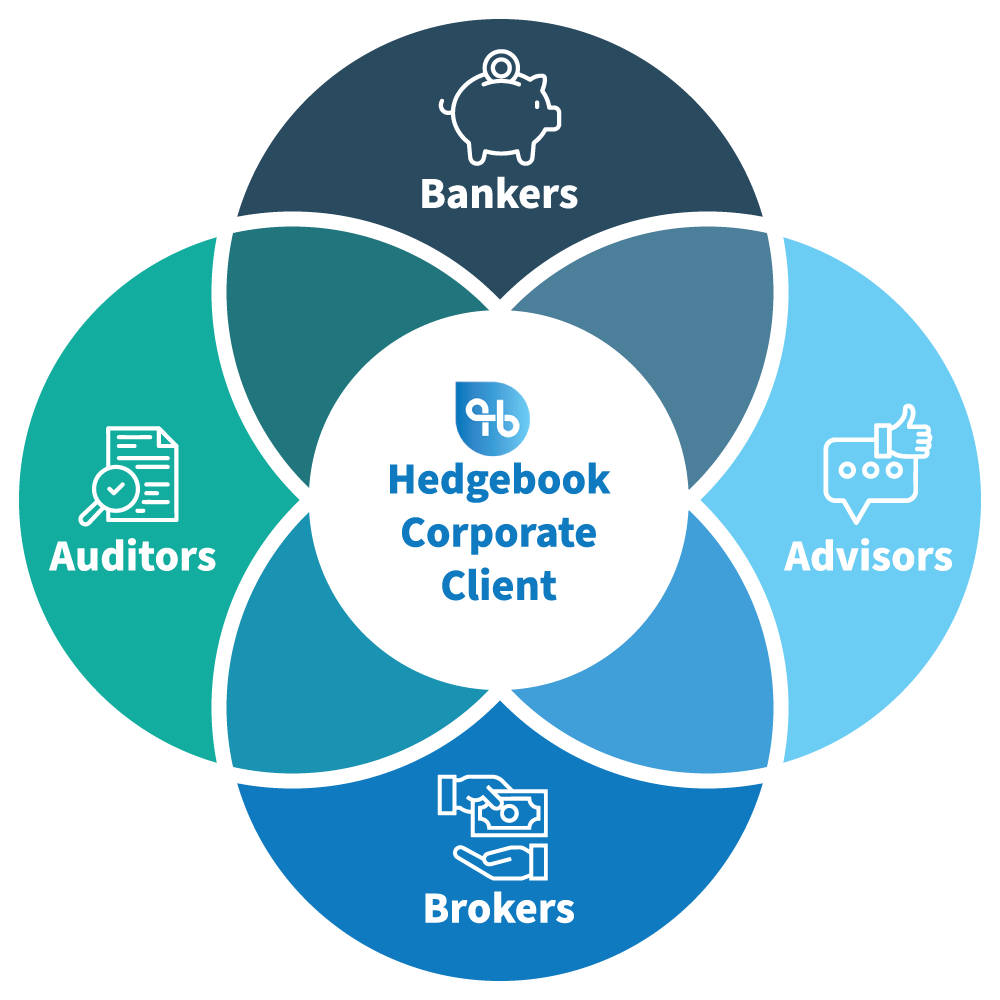

Formed in 2011, Hedgebook is on a mission to help businesses of all sizes make sense of treasury risk, devise profit-protecting strategies and collaborate more efficiently with banks, brokers, auditors and advisors.

It enables Hedgebook customers to sit at the heart of an eco-system where all the various players are able to effectively manage their areas of specialisation while collaborating as and when they need to.

Hedgebook’s core values

Our market-leading SaaS platform delivers on that mission with the four pillars of our values driving everything we do today:

Accessible

Intuitive

Responsive

Knowledgeable

Richard Eaddy

Jason Gaywood

Duncan Shaw

Ian Ross

Jane Smallfield

Companies and Partners we work with

Hedgebook works with a diverse range of organisations. It provides a fit for purpose solution for a wide range of corporate customers who are primarily hedging and managing derivatives. This includes Local Government organisations who have a primary focus in managing interest rates and related risk.

They are supported by their treasury advisors, banks and brokers who use Hedgebook to have shared insight into their client portfolios – enabling them to give better, more timely advice. Auditors have a very specific usecase in providing financial instrument valuations and compliance

As a result, Hedgebook is trusted to manage some of the most volatile currencies and interest rates on the planet for some of its biggest brands – including 75% of the top 30 audit firms in the UK.