The UK’s Financial Reporting Council has completed its Periodic Review 2024 of FRS 102. Most amendments are effective for accounting periods beginning on or after 1 January 2026 .

The updates aim to bring UK GAAP closer to IFRS without impacting entities outside full IFRS.

For treasury teams and auditors, the headline change is fair value measurement. FRS 102 now adopts the IFRS 13 fair value framework, including the requirement to include non‑performance risk in liability valuation – which means considering the entity’s own credit risk.

As a result, entities reporting under FRS 102 must incorporate credit valuation adjustment (CVA) and debit valuation adjustment (DVA) where relevant, and auditors will expect to see robust evidence for those adjustments.

The change in plain English

- Alignment with IFRS 13: Fair value of financial instruments is a market‑based measure. For liabilities, it must reflect the entity’s own credit standing for negative mark-to-markets.

- Who is affected: UK entities reporting under FRS 102 (not IFRS) – typically smaller and mid‑sized companies – need to consider CVA/DVA on derivatives and other relevant instruments.

- When it applies: 1 January 2026 effective date for most amendments. That means you need to plan now for your 2026 year‑end reporting.

Why this matters

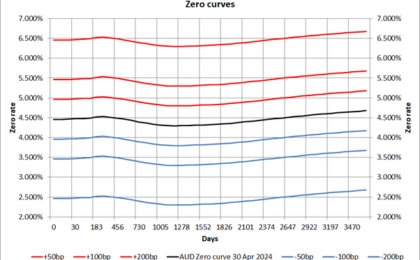

If your valuation process stops at a risk‑free mark‑to‑market, it will no longer be sufficient. CVA/DVA require appropriate credit curves, observable inputs where available, market‑participant assumptions and a repeatable control environment.

And that is where Hedgebook comes onto your radar. It is a secure cloud-based TRMS, trusted by companies all over the world (including 75% of the UK’s top 30 Audit firms) – that can be installed in a matter of hours. It is designed for non-technical users and gives you shared views with your banks, FX brokers and advisors.

The Hedgebook team’s perspective on FRS 102

From our work with corporates and audit firms, two themes stand out:

- Pick a pragmatic, defensible method

FRS 102 does not prescribe a single model. For organisations using vanilla derivatives, a current‑exposure approach with appropriate credit spreads can be a practical choice – provided the inputs, assumptions and controls are documented. Expect auditors to review credit curve construction, data sources and sensitivity analysis. - Be audit‑ready by design

Auditors will test whether CVA/DVA was required, how it was computed, and how your own credit risk was reflected in liabilities. Clear methodology notes, reproducible reports and an audit trail will save time on both sides.

Why spreadsheets struggle here

CVA/DVA workflows strain spreadsheets: stitching risk‑free curves to credit spreads, interpolating credit curves, scaling across portfolios, and maintaining an audit trail and that’s without doing the underlying mark-to-market valuation. IFRS 13’s emphasis on market‑participant assumptions and observable inputs is better met by systems that embed reliable data and transparent, repeatable techniques.

How Hedgebook helps with FRS 102 management

Hedgebook delivers independent, third‑party valuations and CVA/DVA in line with IFRS and FRS102, with the reports auditors ask for. Coverage includes FX forwards, swaps and options, interest rate swaps and commodities, with integrated market data and exportable, audit‑ready outputs. That is why 75% of the UK’s Top 30 audit firms use Hedgebook for 3rd party, independent, valuations.

- Built‑in CVA/DVA: Create counterparty and own‑credit curves, apply them portfolio‑wide, and report risk‑free value, adjusted fair value and the CVA/DVA amount by instrument.

- Audit‑ready outputs: Independent valuations, sensitivity reporting and a clear audit trail to streamline review and sign‑off.

- End‑to‑end instruments and reporting: Record, value and report across FX, interest rate and commodity derivatives – with popular reports including instrument detail, FX and IR sensitivities, and interest accruals.

Strategic upside: Treasurers gain speed and consistency. Auditors get transparent, independent evidence. Boards benefit from clearer, policy‑aligned risk insight.

FRS change checklist – how prepared are you?

- Select and document your CVA/DVA methodology – make sure it is suitable for your instruments and scale.

- Source credit data for counterparties and your own entity, and define curve‑building and maintenance.

- Automate valuations and reporting to ensure repeatability, controls and an audit trail.

- Run sensitivities and materiality tests so audit discussions start from evidence, not estimates.

FAQs about the FRS 102 fair value changes

Does FRS 102 now require own‑credit risk in liability fair value?

Yes. The amendments align with IFRS 13, requiring entities to consider non‑performance risk, including own‑credit risk, when measuring the fair value of liabilities.

When do I need to apply the new fair value guidance?

For periods beginning on or after 1 January 2026.

What will auditors expect to see on CVA/DVA?

A documented method, data sources for credit curves, evidence that liability fair values include own‑credit risk where relevant, and reproducible reports with an audit trail.

Next steps

If you want to see how Hedgebook calculates fair values and CVA/DVA in accordance with IFRS – all at the push of a button – we are only too happy to show you.