While Hedgebook was historically known as an FX risk management tool it is equally relied upon for managing the risk around Interest Rate Swaps and providing third party independent valuations for reporting.

Customers using Hedgebook’s Interest Rate Swaps functionality cover a wide spectrum of companies and applications. We thought it would be useful to bring together insights some of them have shared to help others considering a tool for managing Interest Rate Swaps.

Contents

-

-

-

-

-

-

- Simplifying Interest Rate Swap Management

– Streamline swap tracking, valuations, and oversight by replacing manual processes.

3 - Accurate and Independent Valuations

– Providing consistent, real-time, independent valuations to support transparent financial reporting and accounting standards.

4 - Enhancing Treasury Reporting and Compliance

– Automate treasury reporting to meet internal governance and external compliance requirements.

5 - Improving Audit Processes

– Reliable, transparent swap valuations that simplify and support audit reviews.

6 - Replacing Spreadsheets with a Centralised System

– Consolidates interest rate management into one secure, accessible, and automated platform.

7 - Supporting Debt Management and Risk Mitigation

– Manage debt-related interest rate exposure proactively and strategically.

8 - Collaboration Between Internal Teams and Advisors.

– Shared access to accurate, real-time treasury information for better decision making.

9 - IFRS Compliance and Audit Readiness

– Simplify alignment with IFRS and other accounting standards. - Market Data Integration

– Integrate market rates to keep valuations and risk insights always up to date . - Scenario Planning and Forecasting

– Model future interest rate impacts to improve cash flow and hedging strategies . - Automated Reporting and Insights

– Customisable, real-time reports to enhance decision-making across the business . - Integration with Other Treasury and Accounting Systems

– Seamlessly connect with other systems to maintain data consistency and efficiency .

- Simplifying Interest Rate Swap Management

-

-

-

-

12

-

1. Simplifying Interest Rate Swap Management

Managing interest rate swaps can be complex, requiring precise tracking and accurate valuations. Hedgebook simplifies this process, offering a centralised platform to remove the reliance on spreadsheets. By automating key calculations and reporting, businesses gain real-time oversight of their interest rate risk positions.

Port Otago transitioned to Hedgebook to improve the efficiency of its interest rate hedging across large infrastructure projects and investment in significant items of port property and plant, as well as other significant marine assets.

The platform provides clarity and accuracy, ensuring all hedging activities are managed with minimal manual intervention. This shift allowed the company to focus on strategic decision-making rather than administrative tasks.

“Hedgebook has proven to be a fantastic product in terms of getting an up-to-date mark-to-market at any time. While we don’t necessarily use it every day, if we do want to get a feel for where things are at on a daily basis – we can. It is incredibly easy to use and very timely in terms of information”. Malcolm Roberts, Group Accountant, Port Otago

Nelson City Council also found value in Hedgebook’s swap management tools. The platform enabled the finance team to independently track interest rate swaps, ensuring compliance and enhancing internal control over financial instruments.

“We enter, maintain, and check the data ourselves – managing it all from start to end in Hedgebook. It is a lot easier than having someone trying to do this for us. Nobody is making assumptions that aren’t correct – we know firsthand what it should look like – and why.” Prabath Jayawardana, Manager Finance, Nelson City Council

2. Accurate and Independent Valuations

Hedgebook delivers accurate and independent valuations for interest rate swaps, ensuring finance teams have full transparency over their hedging instruments. By removing the reliance on counterparty valuations, businesses gain confidence in their financial reporting and compliance with accounting standards. The platform automatically updates valuations , providing a clear view of the mark-to-market position without manual intervention.

Hedgebook’s valuation methodology is aligned with industry best practices, ensuring that valuations are consistent, reliable, and audit-ready. The platform accounts for market conditions, discount factors, and counterparty credit risk to provide precise calculations. This eliminates discrepancies between internal and bank-provided valuations, reducing potential disputes.

Finance teams also benefit from Hedgebook’s ability to generate historical valuation reports, which provide a clear audit trail and facilitate trend analysis. This feature supports better forecasting and strategic planning by allowing businesses to assess past hedging decisions and refine future strategies.

Hedgebook’s flexibility extends to policy tracking and interest payment management, allowing organisations to customise the platform according to their specific requirements. This customisation ensures that as businesses grow and their financial landscapes become more complex, Hedgebook remains a valuable tool in managing various aspects of treasury operations.

The fact Hedgebook did third-party independent valuations was a big part of its attraction for global fleet management provider, EROAD.

“With Hedgebook we can literally get that third-party valuation in an instant whenever we need it. Plus, because it can be back dated, I am not tied to doing it right on the end of the month. For that alone Hedgebook pays for itself – but as we’ve learnt there is a lot more to it than that.” Kim O’Hara, Finance Manager at EROAD.

3. Enhancing Treasury Reporting and Compliance

Accurate and timely treasury reporting is critical for businesses managing interest rate risk. Hedgebook provides comprehensive reporting tools that ensure compliance with financial regulations and audit requirements. Automated reporting features simplify month-end and annual reporting, reducing manual errors and improving efficiency.

Top Energy uses Hedgebook to track its interest rate exposure and generate audit- ready reports. The platform ensures that valuations are consistent, reducing the risk of discrepancies and ensuring alignment with accounting standards.

“While we have our swaps out five years our book doesn’t move too much but the valuations can. We can have millions of dollars moving from month-to-month just on the valuations.

“It doesn’t really mean much until it settles as we are not trading for profit, but we still need to manage it. And ultimately, to do that, we need a tool to provide checks and balances through the process and provide accurate reporting and valuations when it comes to the audit. Hedgebook ticks all those boxes.” Paul Thompson, Financial Controller, Top Energy

Hurunui District Council benefits from Hedgebook’s single-click reporting functionality. By integrating treasury data into one accessible system, the council can quickly produce reports that meet audit and compliance expectations without excessive manual input.

“The primary reason we started using Hedgebook is to calculate our end of year position for reporting – with accurate valuations on interest rate swaps and derivatives. It never ceases to amaze me that I can create a report with the push of a button in Hedgebook and know our auditors will be more than happy it’s correct.”Bradley Phillips, Financial Accountant, Hurunui District Council

With automated hedge accounting reports, Hedgebook helps businesses track and document their compliance with IFRS standards without the need for complex manual calculations. The platform provides detailed disclosures required for financial reporting, ensuring transparency and consistency across reporting periods.

4. Improving Audit Processes

Interest rate swap management must align with audit requirements to ensure financial accuracy and compliance. Hedgebook enhances audit processes by providing robust, transparent valuations and a structured reporting framework.

Johnston Carmichael is a leading UK firm of chartered accountants and business advisors. Hedgebook has enabled Johnston Carmichael to audit interest rate swaps and valuations far more efficiently with a better quality of audit evidence.

“We were relieved to find a tool to do this for us that was both third party independent and ensures we are compliant with the auditing standards.

“I love the ease of using Hedgebook. It is quick and easy for our team to implement, and the output is easy for a reviewer to read. You can easily match the impact of

the output, over input, and identify if there are any issues. This extends to using Hedgebook in the financial services sector of the business as well, for valuing foreign currency forward contracts for companies that trade internationally.”“The old way of doing all of this was to use a spreadsheet. It was difficult to keep updated, kept information in silos and there was a greater risk of something going wrong. I don’t think it could do any better on ease of input or getting information out.” Grant Roger, Audit Partner, Johnston Carmichael

5. Replacing Spreadsheets with a Centralised System

Spreadsheets can introduce errors and inefficiencies in treasury management. Hedgebook provides a secure, structured system that consolidates all treasury data into one easily accessible platform, reducing reliance on manual processes.

New Plymouth District Council centralised its treasury data using Hedgebook, improving accuracy and accessibility. The shift from spreadsheets to an automated system streamlined interest rate swap management and reporting – enabling its two financial accountants to manage and maintain all its treasury information in one place.

“We really like the numerous reporting options available for monitoring and analysis. It has become an important part of our accounting and reporting requirements including automatically calculating accrued interest for accurate monthly reporting – such as journaling accrued interest as at month end.

“It also reduces the risk of calculation/input errors when preparing end-of-year workpapers for external auditors to support disclosures in the Annual Report.” Loren Moore, Financial Accounting Lead, New Plymouth District Council

Port Otago replaced its complex spreadsheets with Hedgebook, benefiting from enhanced data integrity and simplified hedge tracking.

“There are vastly more expensive tools out there, but they aren’t going to give us any better information than Hedgebook. When we say the numbers are from Hedgebook, the auditors and other financial advisors immediately identify it as a trusted source. When you bring together the cost effectiveness, accuracy and responsiveness of Hedgebook, it is a no-brainer really.”Malcolm Roberts, Group Accountant, Port Otago

6. Supporting Debt Management and Risk Mitigation

Interest rate risk is a key consideration for organisations with debt portfolios. Hedgebook enables proactive risk management by providing visibility into interest rate exposures and supporting strategic decision-making.

Top Energy uses Hedgebook to monitor its debt-related interest rate risk, ensuring financial stability and effective hedging strategies. The platform’s analytics allow for scenario modelling, helping to mitigate potential risks.

“As part of our debt structure we capture all the term debts into Hedgebook and from that we are able to get the cashflows and interest rates coming off the term borrowings. As part of the term borrowings we enter into interest rate swaps which we capture in Hedgebook to manage the valuations.

“In addition, we capture interest rate swaps for cash flow purposes and get the cashflow projection coming out of Hedgebook to extract the interest received and paid on the swaps. Another thing we capture in Hedgebook is our forward exchange contracts as it’s another derivative for cashflow purposes.”Paul Thompson, Financial Controller, Top Energy

Port Otago actively manages debt using Hedgebook, leveraging its tools to assess exposure and adjust hedging strategies accordingly. This approach helps maintain financial resilience in fluctuating interest rate environments.

“Hedgebook has proven to be a fantastic product in terms of getting an up-to-date mark-to-market at any time. While we don’t necessarily use it every day, if we do want to get a feel for where things are at on a daily basis – we can. It is incredibly easy to use and very timely in terms of information”.Malcolm Roberts, Group Accountant, Port Otago.

7. Collaboration Between Internal Teams and Advisors

Effective collaboration between finance teams and external advisors is essential for strong treasury management. Hedgebook facilitates this by providing a shared platform where data is accessible in real time, improving decision-making and transparency.

Global fleet management provider, EROAD’s treasury advisors, Barrington, have a direct login to its Hedgebook instance so they can review what is happening in real time.

“Being able to see online and on a real-time basis EROAD’s FX hedged positions, ensures we are able to provide timely and relevant advice, particularly when markets are moving around. It also ensures the one single source of information we are all working with. Hedgebook is a very effective and efficient means, assisting advice between us and EROAD.” Chris Hedley, Treasury Advisor, Barrington

Johnston Carmichael uses Hedgebook to enhance collaboration with its clients, ensuring all parties have a clear understanding of hedging positions and valuations. The platform’s shared access improves audit efficiency and financial accuracy.

“There is no need to talk to clients if Hedgebook’s valuation is within an acceptable threshold of variation to that of the third-party bank valuation. We only comment if the variance is outside an acceptable range.

“Because it is a third-party tool, clients are much happier to go back to the bank than if it was us, as the auditor, raising the issue from our own calculations. It gives everyone the ability to have a really good conversation in getting any potential valuation issues addressed.” Grant Roger, Audit Partner, Johnston Carmichael

8. IFRS Compliance and Audit Readiness

Meeting International Financial Reporting Standards (IFRS) and local accounting standards is a critical requirement for many organisations. Hedgebook simplifies compliance by generating valuations and reports that align with IFRS 9 and other regulatory requirements. The platform ensures financial statements reflect the true economic value of interest rate hedging activities, reducing the complexity of audits and financial reporting processes.

Hedgebook’s built-in effectiveness testing ensures that interest rate swaps qualify for hedge accounting treatment. By automating this process, finance teams can quickly identify whether hedges meet regulatory requirements, reducing the risk of financial restatements and enhancing the credibility of financial statements.

Manawa Energy sought an independent valuation tool to meet IFRS accounting standards for both Interest Rate Swaps and Foreign Exchange. It landed on Hedgebook due to its ability to meet IFRS and other accounting standards including US GAAP / AASB.

“Currently we use it on at least a monthly basis to do our ‘fair values’. If we trade FX or interest rate swaps we record that in Hedgebook at the time. We also use it to do independent valuations, credit value adjustments and other sensitivities for half year and year end reporting.

“For the basic stuff we currently use Hedgebook for, it is simple and works well. Auditors trust it and it won’t cause you any heart ache. The system has always worked, and we have never had any issues at year end.” Karl Wansbone, Head of Finance, Manawa Energy

9. Market Data Integration

Hedgebook integrates market data, ensuring valuations and reporting are based on the most current interest rate movements. This real-time visibility allows businesses to monitor their hedging effectiveness continuously and make timely adjustments to their interest rate swap positions, maximising financial efficiency.

The integration of market rates eliminates the need for manual data input, reducing errors and improving the accuracy of financial models. Furthermore, Hedgebook helps to identify when significant market movements occur, enabling finance teams to reassess and adjust their hedging strategies accordingly.

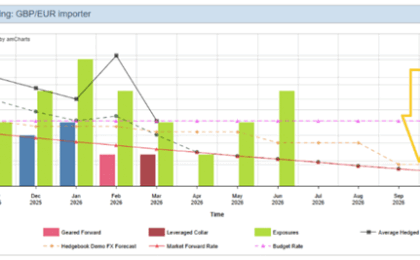

10. Scenario Planning and Forecasting

The ability to model different interest rate environments is a key advantage of Hedgebook. The platform enables finance teams to forecast interest expenses under various scenarios, helping them assess future cash flow obligations and adjust their hedging approach accordingly.

Hedgebook allows businesses to compare multiple hedging strategies, helping finance teams determine the most cost-effective approach. By running different simulations, companies can evaluate the trade-offs between different hedging instruments and select strategies that align with their risk appetite and financial goals.

11. Automated Reporting and Insights

Hedgebook streamlines the reporting process by generating automated reports on interest rate swap valuations, effectiveness testing, and cash flow projections. These reports ensure stakeholders—from CFOs to board members—have instant access to relevant financial insights, saving valuable time and improving decision-making efficiency.

The platform offers customisable report templates that can be tailored to meet the specific requirements of different stakeholders. Whether it’s an executive summary for senior management or a detailed risk report for auditors, Hedgebook ensures that the right information is available in a structured and digestible format.

12. Integration with Other Treasury and Accounting Systems

Hedgebook integrates easily and seamlessly with existing treasury and accounting systems. This reduces manual data entry, minimises errors, and enhances the overall efficiency of treasury operations. The ability to consolidate financial instruments within a single platform improves visibility and control over all hedging activities.

The platform supports API-based integrations, enabling real-time data transfer between Hedgebook and other financial software solutions. This connectivity enhances operational efficiency by eliminating the need for duplicate data entry and ensuring consistency across financial records.